Invent

With Meteora

There are a million ways to launch on Solana. Use our comprehensive set of tools to customize and INVENT your perfect launch.

Powering the Best Launchpads

Launch your token easily with your preferred launchpad!

Believe

Bags

Jup Studio

Moonshot

PMX

daos.fun

Moonit

Open Game Protocol

Boop.fun

time.fun

Trendex

Anoncoin

Soar

Cooking City

Candle.tv

Trends

Bitdealer

Gitfish

Bunt

Opinions

Bands

indie.fun

Audius

Coined

Peek

Star

RevShare

Toy Machine

CyreneAI

Collaterize

Starseed

Virtuals Protocol

Pump Science

Klout

something

SendShot

Dialect

Shout

ShopTank

Ethics

Forge

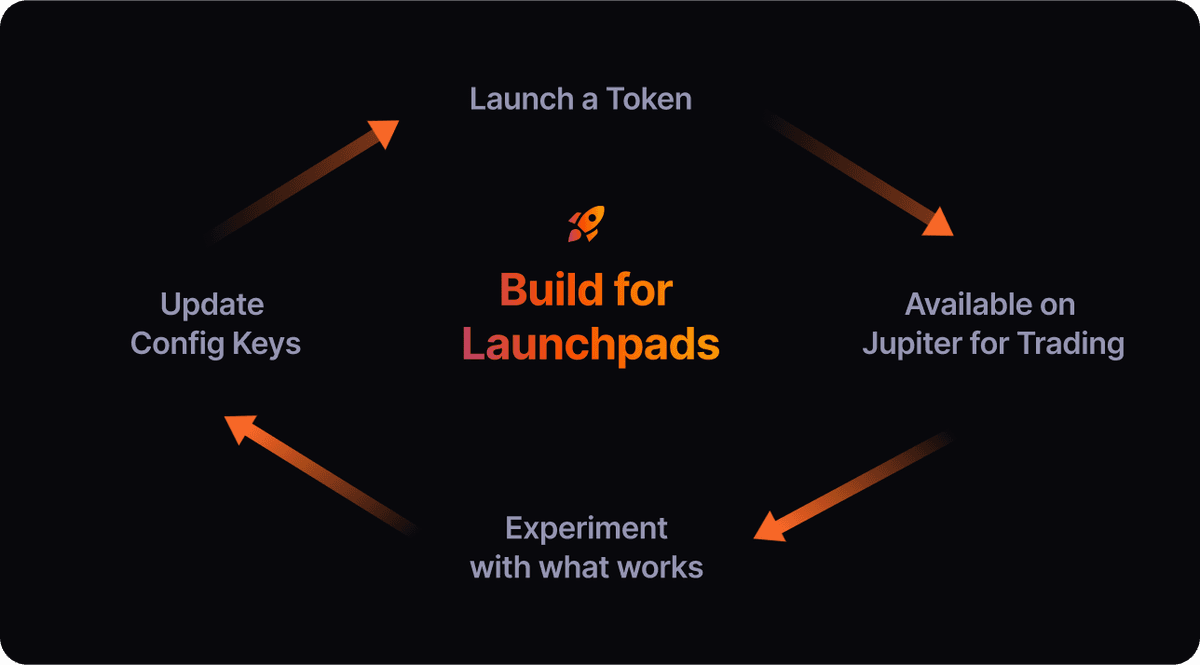

Launch ProductsLaunch Products on Meteora

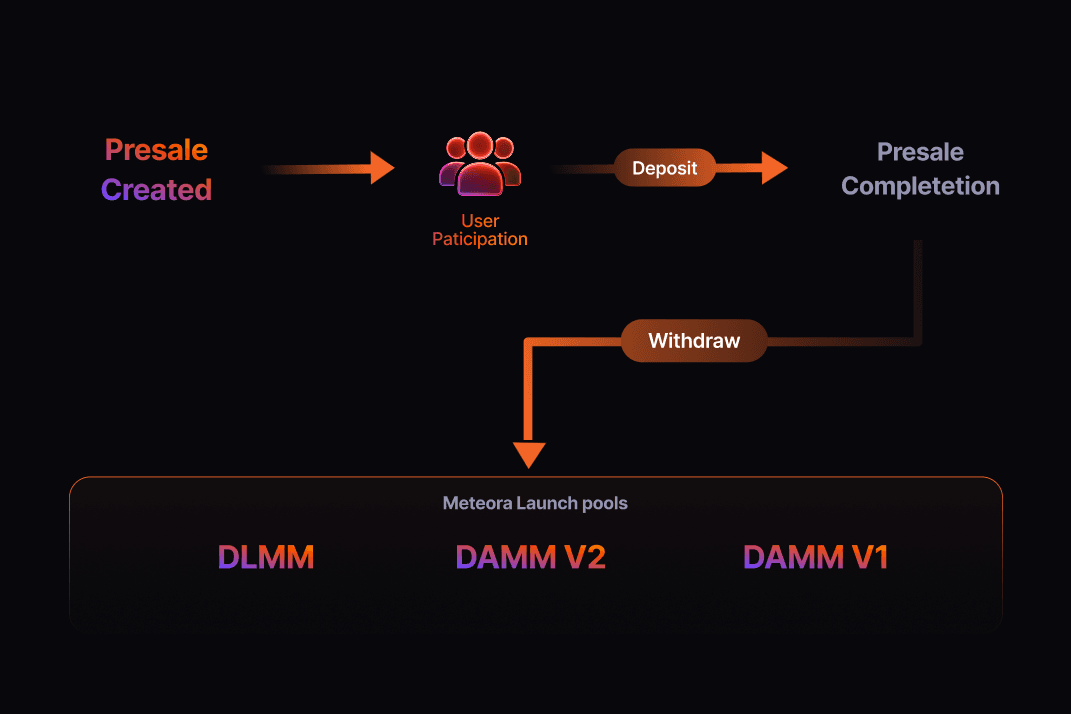

DLMM Launch Pool

Dynamic Liquidity Market Maker

- Setup Pools with single-sided liquidity, no USDC or SOL required

- Super Customizable & Flexible, specify the price and distribution

- Liquidity Lock: Specify for how long liquidity will be locked

Case Study: JUP

- TVL: $164M

- Volume: $300M

- Fees: $20M

Case Study: CLOUD

- TVL: $25M

- Volume: $29M

- Fees: $500K

DAMM v1 Launch Pool

Dynamic Automated Market Maker

- Reliable Price Discovery from 0 to Infinity (No Max Price)

- Deter Snipers with Fee Schedule

- Permanently burn liquidity while still collecting fees

DAMM V2 Launch Pool

New and Improved Hybrid DAMM x DLMM

- Hybrid: Choose between Single-Sided Liquidity or Full-Range

- Comprehensive Fee System: Deter Snipers or Maximize Trading Fees

- Permanently burn liquidity while still collecting fees

- Specify fees only in Quote Token (USDC or SOL etc.)

Dynamic Bonding Curve

Customizable bonding curve program for virtual price discovery

- Fully Customizable: Flat/Linear/Exponential Curves

- Access Jupiter integration and more for the best discovery

- Experiment with various settings to launch a new token

- Configurable bonding curve and graduated LP fees

- Control price discovery and liquidity distribution

Universal Curve: The Future of Dynamic Liquidity

Universal Curve is a 16-point customizable curve system that lets LPs program their liquidity with unprecedented precision.

Extension Programs for LaunchesHelper Programs for Launches

Presale Vault

Initialize a Token Presale with Meteora's Presale Vault

- Support for any SPL token, including Token 2022.

- Up to 5 user buckets with customizable deposit limits.

- Fixed Price, Prorata, or FCFS presale modes.

- Permissioned (whitelist) or permissionless setups.

- Flexible locking and vesting with immediate or gradual release.

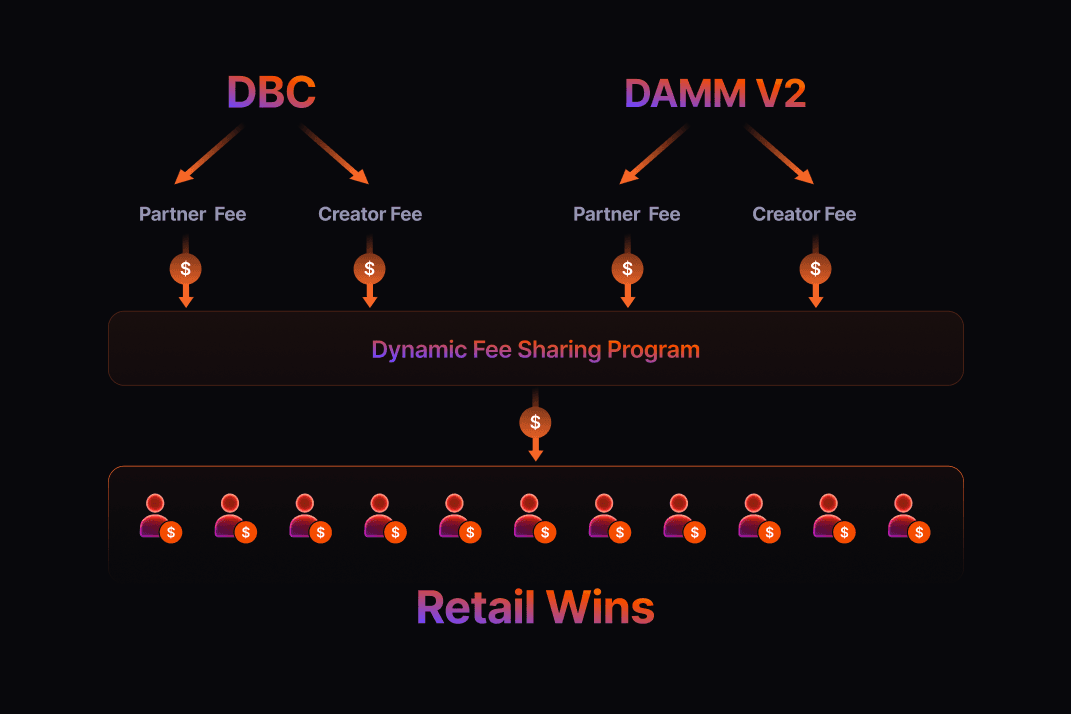

Dynamic Fee Sharing

Dynamically Configure the Sharing of Fees with Anyone

- Secure fee collection and distribution for SPL and Token-2022 tokens.

- 2–5 users per vault, each with configurable shares.

- Robust anti double-claim: individual tracking and checkpoints.

- Pro-rata, real-time distribution with gas-efficient lazy evaluation.

- Partial funding and claiming for workflow flexibility.

Stake2Earn

Meteora's Innovative Mechanism to deliver Day 0 Utility

- Claim Trading Fees from Locked Liquidity

- Lock Liquidity, but claim fees forever.

- Direct Fees towards Creator/Stakers

Anti Sniper Suite

Alpha Vault

Give your community the First Buy with the Alpha Vault. Collect trading fees from locked liquidity positions.

- 1Offer Deposits in USDC or SOL

- 2Depositors frontrun the Bots

- 3Claim Proceeds or USDC/SOL

Let the Community Frontrun the Bots

Customization Available

Available on any Meteora Launch Pool

Fee Scheduler

Deter sniper bots by imposing higher fees during the start of the launch that decays over time till an ending base fee.

- 1Start with High Base Fee (up to 99%)

- 2Fee Decay Linearly or Exponentially

- 3Remaining Trades at Ending Base Fee

Configurable Fee Scheduler

- Set a high initial base fee (up to 99%)

- Fee decays over configurable periods and intervals

- Choose Linear or Exponential decay to fit your launch needs

Relative to Time

Available on certain pools

Rate Limiter

Deter sniper bots by increasing the fee depending on the trade size. The bigger the trade, the higher the fee.

- 1Configure a Minimum Base Fee

- 2Set a Reference Amount and Fee Increment in BPS

- 3The Larger the Trade, the Higher the Fee

Configurable Rate Limiter

- Set a Base Fee and Reference Amount

- Fee increases for larger trades

- Use with quote token buy swaps only

Relative to Trade Size

Available on certain pools

Confused? We Got You

We're here to help you out! If you're confused or have questions, hop into our Discord community